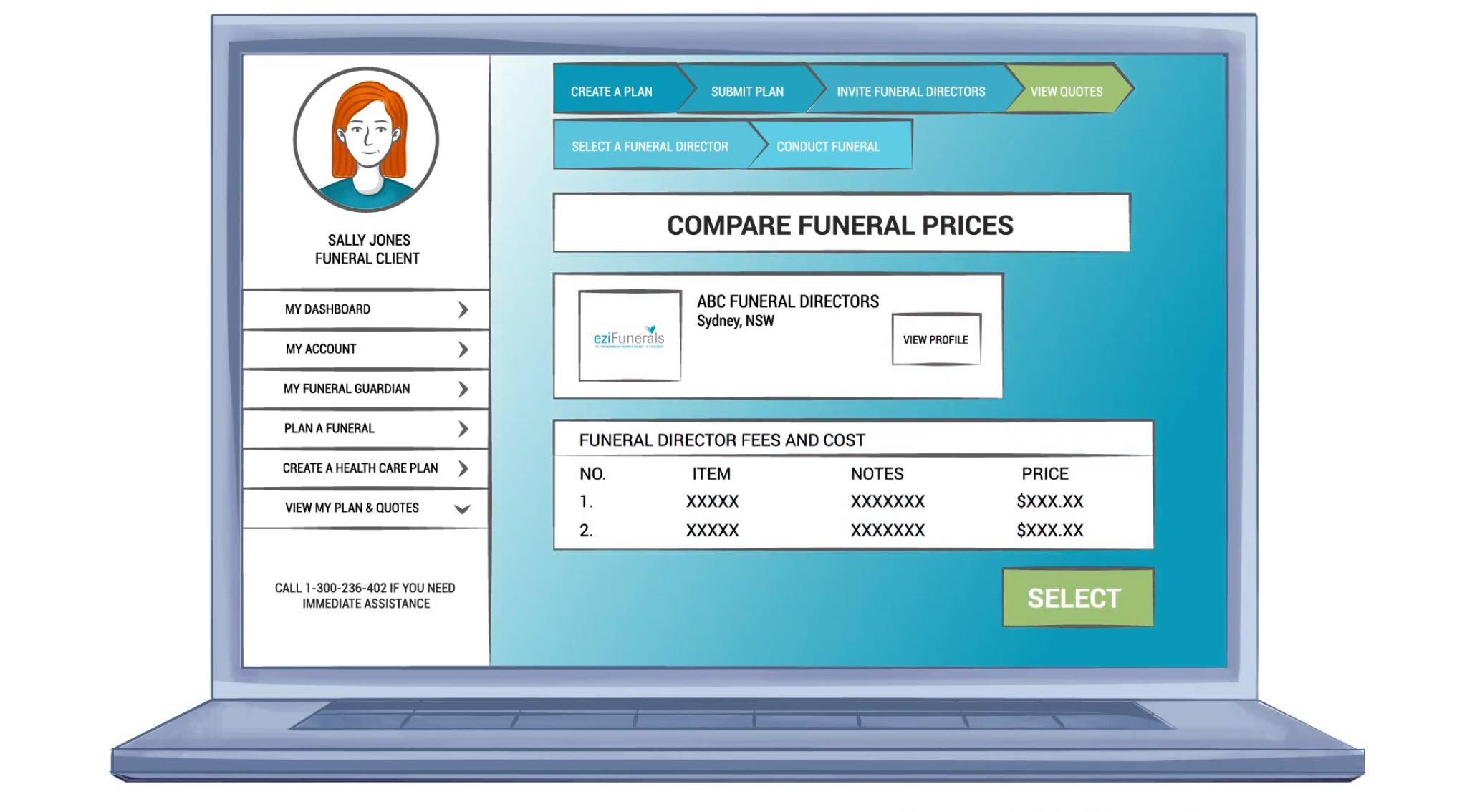

At eziFunerals, we believe everyone should be able to access low-cost and easy-to-understand funeral bonds. That’s why we support funeral plan providers that offer safe and secure funeral bonds. With funeral bonds, you don’t have to be tied to a funeral director. This way, your family can shop around for funeral directors on service and price.

A Smart Choice for Retirees and Pensioners – Funeral Bonds in Australia

As retirees and pensioners, planning for the future involves making sound financial decisions that ensure a comfortable retirement and protect loved ones from the burden of funeral expenses. One effective financial tool available in Australia is investing in funeral bonds. In this comprehensive guide, we will delve into the advantages of funeral bonds for retirees and pensioners, exploring their potential for financial security, tax benefits, and the peace of mind they offer for your future.

GET QUOTES

Are funeral bonds a good investment?

Funeral bonds are invested in conservatively managed funds with which to put aside funds for your funeral expense. You can either invest a lump sum, or make regular or ad-hoc deposits from as little as $50 per month. Therefore, it can be an ideal funeral saving plan.

One of the benefits of funeral bonds, especially for retirees, is that the money invested for the funeral is exempt under Centrelink’s means testing.

With Funeral Bonds you are not locked into a contract to pay monthly funeral insurance premiums. You choose how much you wish to contribute and you are free to change your saving program at any time. And crucially, as you do not have to make compulsory payments (as with funeral insurance plans).

With funeral bonds, you will be unable to access your funds after the 30-day “cooling off” period.

CASE STUDY: Jack decides to buy a funeral bond

When Jack decided to get his finances in order, he wanted to make arrangements to pay for his funeral.

Jack decided to buy a funeral bond with some of his retirement savings. He decided to invest $10,000 towards his funeral. As an aged pensioner he would receive an asset test-reduced pension and enjoy an immediate pension increase of $30 per fortnight. Over a year, Jack received an extra $780 or an equivalent return of 7.8% on his investment. That’s better than any term deposit rate offered by the banks.

He knew the investment would grow over time. Jack felt satisfied that he had sorted out his funeral costs and his family wouldn’t have to worry.

GET QUOTES

DISCLAIMER: Funeral Bonds advertised by eziFunerals are provided by approved funeral bond providers. Users of this site are subject to eziFunerals privacy policy and terms and conditions. eziFunerals may receive an advertising fee from approved providers.

Conclusion:

Funeral bonds offer Australians a practical and effective way to plan for future funeral expenses while providing peace of mind to themselves and their loved ones. By understanding how funeral bonds work, comparing different options, and seeking professional advice, individuals can make informed decisions and secure their financial future. Start planning today to ensure that your funeral costs are covered and your family is relieved of any unnecessary financial burdens during a challenging time.

GET QUOTES

About eziFunerals

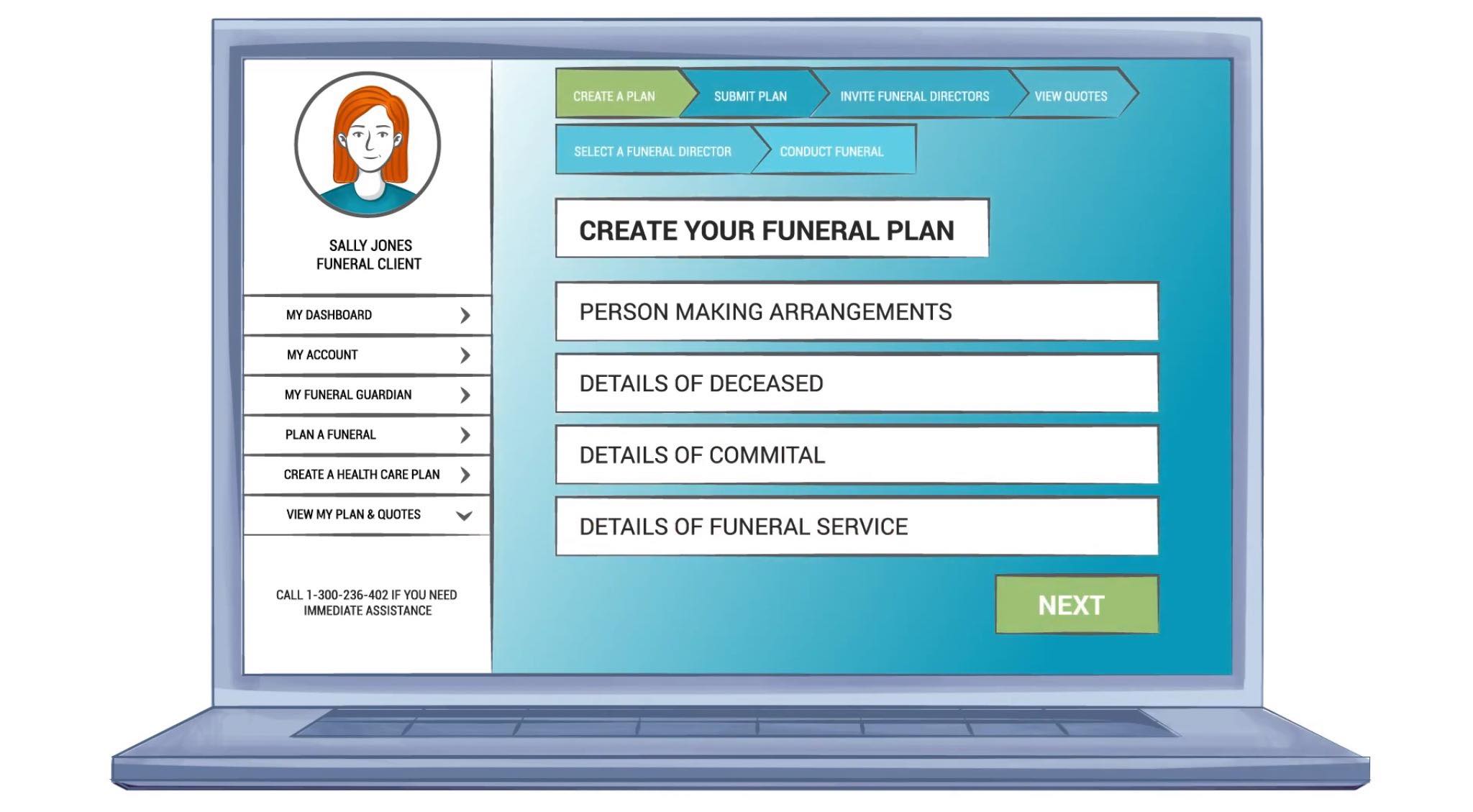

eziFunerals supports individuals and families cope with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company. We are not part of any other funeral company.

Our member Funeral Directors operate in Sydney, Melbourne, Brisbane, Perth, Adelaide and Australia wide. They are chosen for their knowledge, quality, service, personalisation and experience. They go above and beyond, and will take the time to support the family.

For more information or to make contact with a trusted Independent funeral director, call eziFunerals on 1300 236 402 or visit www.ezifunerals.com.au.