A funeral bond is a payment for a consumer’s future funeral which involves the payment of either a lump sum or regular instalments to a friendly society.

It is similar to a prepaid funeral, in that money is placed in a specified fund. The difference lies in the fact the money increases with time and any bonus or credits are added to the bond. The bonus or credits provided by the friendly society are akin to interest accrued on the payment and should not be seen as some other incentive or inducement to obtain the bond.

There are two avenues for a consumer to obtain a funeral bond:

- A consumer may contract with a funeral director of their choice for funeral services who facilitates the deposit of the consumer’s money into a bond account in the name of the consumer.

- A consumer can deposit money into a funeral bond with the friendly society of their choice and can later assign or nominate the bond to a funeral director for the provision of funeral services or to their estate.

Where a funeral bond deposit is facilitated by the funeral director this is integral to the discussion about the funeral, burial or cremation services and is one element of the information provided. The amount of money in the bond account at the time of death is the amount available to cover the funeral expenses.

Key aspects of funeral bonds are:

- All funds are placed in a bond account under the name of the consumer.

- They are capital guaranteed.

- All proceeds and capital from funeral bonds must be used for the sole purpose of contributing to the funeral service.

- Funds are only released after the purchaser has passed away and the funeral services have been provided or conducted.

- The funeral bond does not cease to exist if the consumer stops paying the instalments, though it may not meet the cost of the funeral.

- A funeral bond cannot be withdrawn prior to death.

Funeral bonds also have advantages as they are exempt from the asset and income test for assessing eligibility for the aged pension. It is a means of saving that keeps money for funerals separate from other accounts and investments. This might also be important for those who want a particular type or style of funeral. Funeral bonds enable consumers to pay in advance while allowing details to be worked out later.

The Australian Government has encouraged and supported the use of funeral bonds as a savings approach by ensuring that amounts paid into funeral bonds are not part of a person’s assets and bonus payments (interest) are not part of income for social security purposes such as pension entitlements.

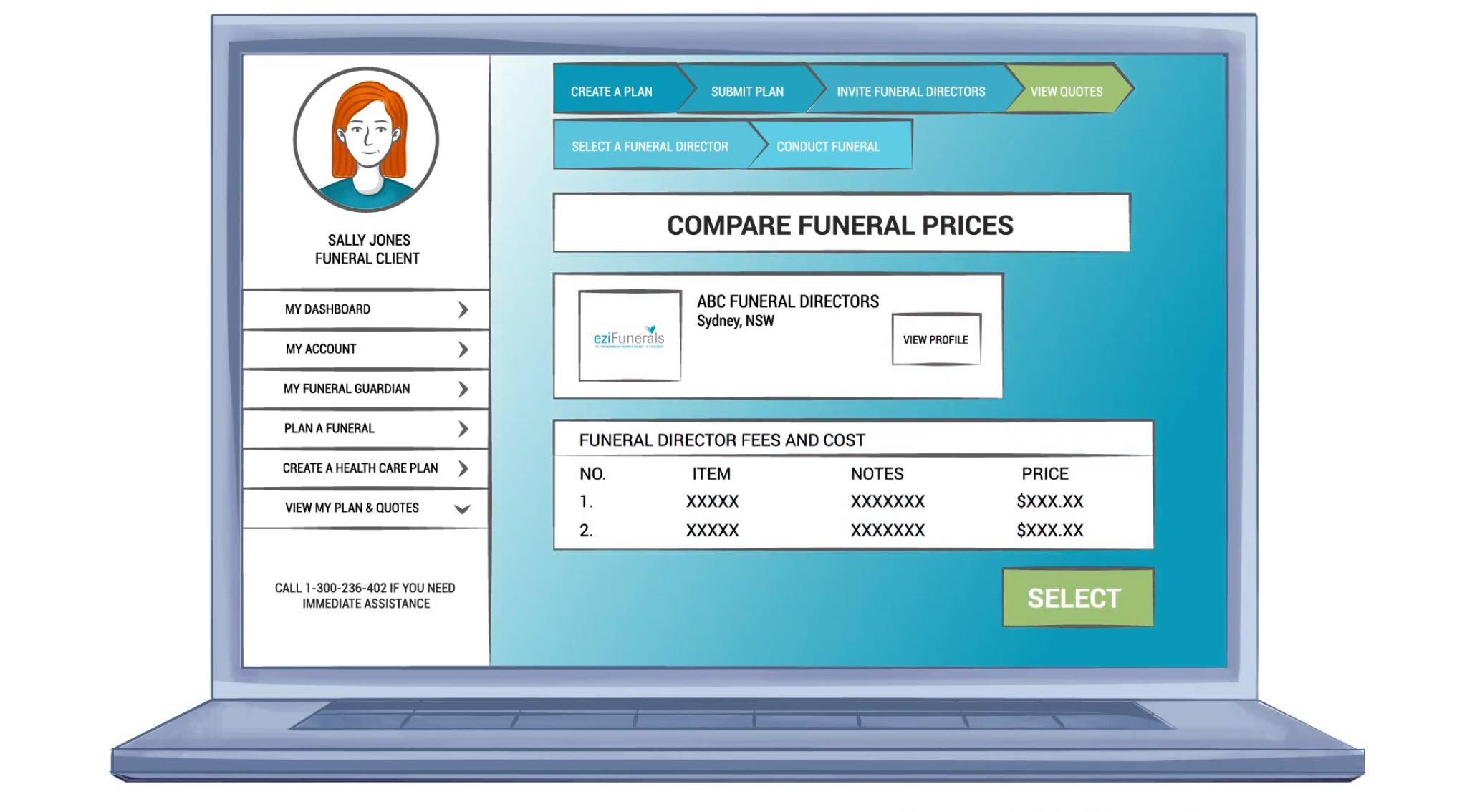

About eziFunerals

eziFunerals supports individuals and families cope with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company. We are not part of any other funeral company.

Our member Funeral Directors operate in Sydney, Melbourne, Brisbane, Perth, Adelaide and Australia wide. Thet are chosen for their knowledge, quality, service, personalisation and experience. They go above and beyond, and will take the time to support the family.

For more information or to make contact with a trusted Independent funeral director, call eziFunerals on 1300 236 402 or visit www.ezifunerals.com.au.