Prepaid funerals have become popular in recent years. They are sold to consumers who wish toprepay their own funeral in order to lock in today’s prices. However, just like any contracts, there are pros and cons with prepaid funeral plans in Australia.

The following guide includes information from Centrelink that you should consider before considering a prepaid funeral in in your City.

How do Centrelink assess prepaid funerals?

When you pay for your funeral in advance Centrelink will require you to get a contract that both:

- sets out the services you’ve paid for

- states that there are no more costs to pay.

As long as you have a contract that says you’ve paid in full for your funeral, your assessable assets for the assets test won’t include either:

- the amount you prepay to a funeral director

- the amount you invest in a funeral bond that has been assigned to a funeral director.

What are the risks of prepaid funerals?

There are risks with any prepaid contract. No matter how attractive the funeral home near you makes it sound, there may be serious drawbacks to prepaid funerals that companies may not tell you about.

Things you should consider:

- If you cancel, move or change your plan, you may not receive a full refund.

- The money you pay for funeral arrangements now won’t be available for emergencies later.

- Money spent today may not cover future funeral costs, which could result in the use of cheaper products or requests for additional money.

- Family members may not be aware that funeral costs have been paid, and may pay at a different funeral home.

- If you die interstate and your family employs another funeral home there, it may be difficult to get a refund.

- By the time of your death, the funeral home may have a poor reputation, or be out of business entirely.

Are there better options?

According to www.moneysmart.com.au, there may be safer and better alternatives to prepaid funerals, such as setting up a special bank account, recording your funeral wishes (pre-need planning) and shopping around. These options reduce the risk of losing your money and provide your family with much greater control when the time comes.

Record your funeral wishes

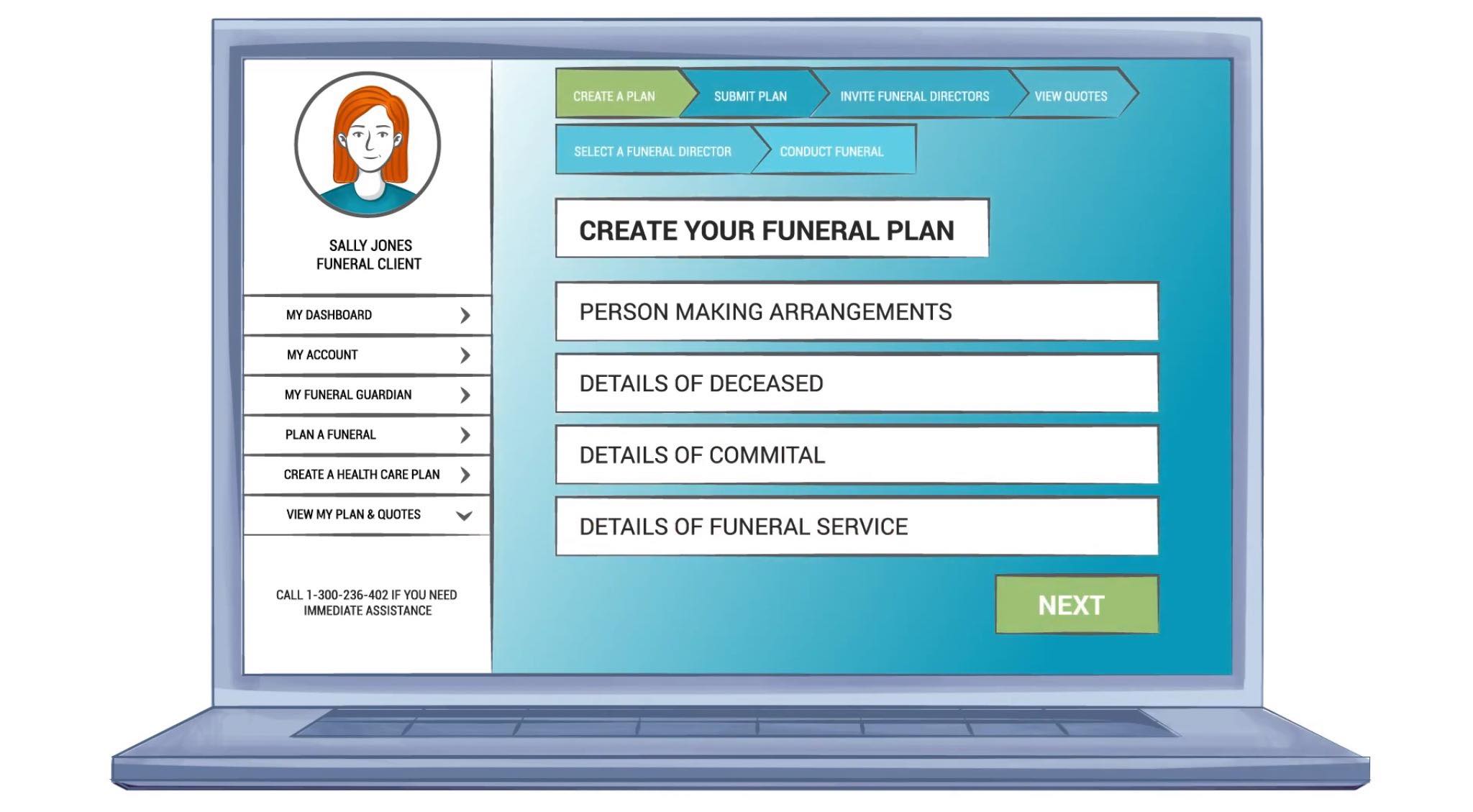

With eziFunerals, you can record your funeral wishes in advance by filling out a pre-need planning form. You can then store it in a secure Dashboard. You can also appoint your funeral guardian/s. Most importantly, be sure to tell your family about your plan. Walk them through every detail. Give them copies of your written funeral wishes.

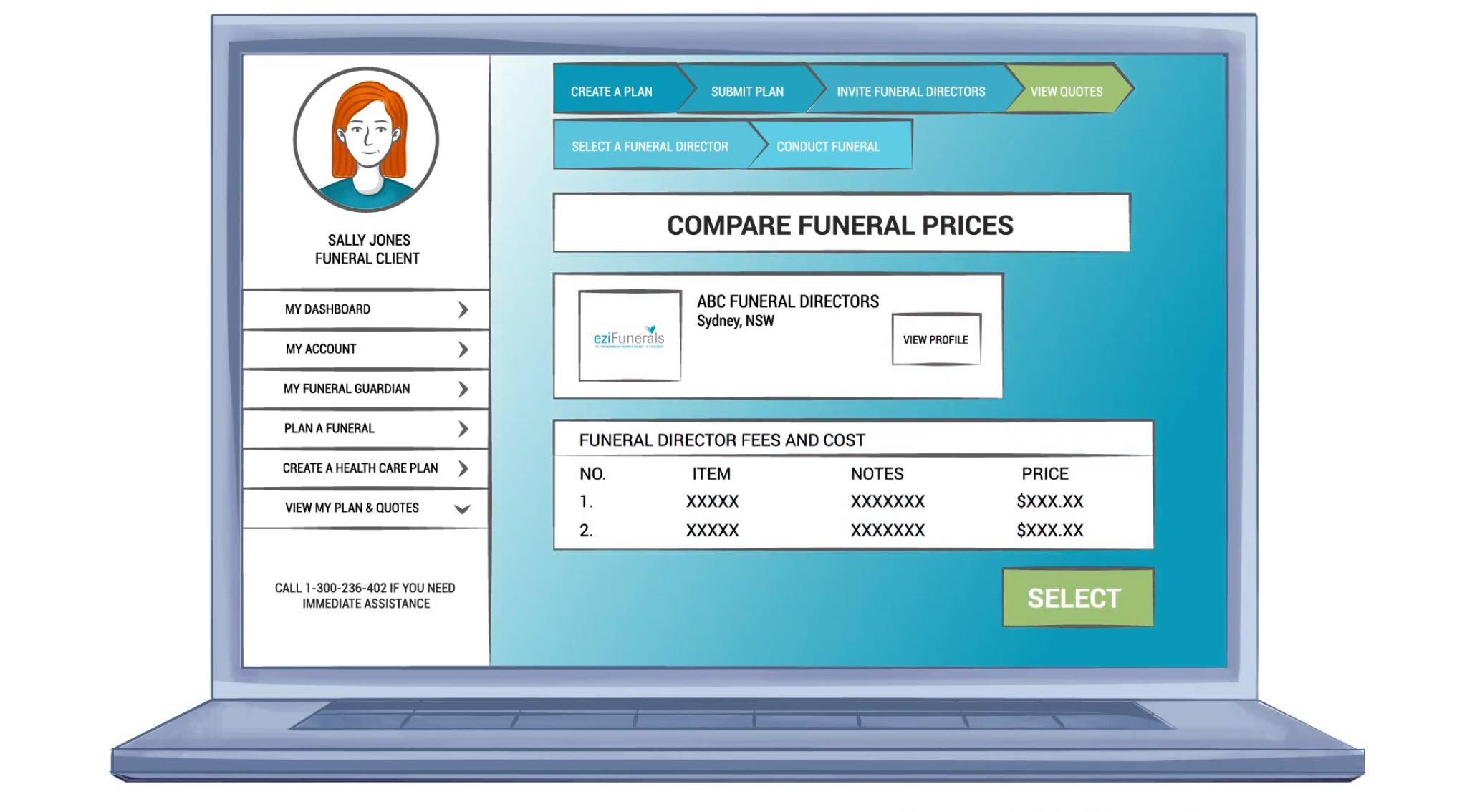

Shop around and get quotes

By comparison shopping, you can make reasonably priced funeral arrangements, without setting aside large sums of money or prepaying anything. eziFunerals helps you get detailed quotes from several multiple homes —and compare prices. You’ll see big price differences for essentially the same goods and services. Visit our list of independent funeral homes, and choose the one you like best.

Call eziFunerals for assistance

Your family will have to make choices after you die and you cannot just prepay these choices away.

You and your family will enjoy greater peace of mind, if you just simply plan ahead without the need to pre-pay your funeral up front. By planning your funeral in advance, your family will be more empowered to shop around and make your funeral arrangements much easier. But if you decide to pre-pay your funeral in advance, be very cautious and read the contract.

About eziFunerals

eziFunerals supports individuals and families cope with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company. We are not part of any other funeral company.

Our member Funeral Directors operate in Sydney, Melbourne, Brisbane, Perth, Adelaide and Australia wide. They are chosen for their knowledge, quality, service, personalisation and experience. They go above and beyond, and will take the time to support the family.

For more information or to make contact with a trusted Independent funeral director, call eziFunerals on 1300 236 402 or visit www.ezifunerals.com.au.