Retirement plans are a big project. Sitting down and working out how you’re going to manage your finances, your asset and your life next is important, and it should be taken seriously and planned for carefully. One of the elements that is going to play a crucial role in that is going to be having your Will either written or updated, so that it reflects your superannuation balance, your assets at the moment of retirement, and anything else that could impact what you choose to leave behind.

Retirement isn’t just about relaxing; it’s about being organised, too!

Once you leave the workforce, there is still a big responsibility to make sure that you’re looking after your financial health and wellbeing. Keeping on top of how much income you have and where it’s sitting is going to be a major priority. If you have properties, if you have investments, these items will need to be administered and looked after in order to keep your position and situation secure.

Writing a Will when you retire means that you’ll be able to take stock of everything that you have access to and have accumulated, think about its value and make some key decisions about what you’d like to see happen to it in the future. It’s an opportunity to sense check your finances and gain a clear picture and understanding of where you’re at.

For many people, retirement is a great time to think about what’s important.

Making a Will means making some big decisions. Choosing an executor and choosing beneficiaries and working out a division of your estate is a serious process that will have a major impact on many people.

For a large percentage of eziFunerals users who have written an online Will, retirement was a great time to slow down and think seriously about what was really important to them, and put that into writing. This is where we’ve seen many people start to commit themselves to leaving gifts behind to charitable institutions and non-profit organisations as well as to their beneficiaries.

Having a Will written at every key moment does matter.

Regardless of any other concern, it’s important to take the time to think about your Will whenever you do reach an important milestone of your life. That does include everything from marriage to separation to divorce, having kids, kids reaching legal age and – yes – it absolutely includes retirement as well.

Any of these milestones could mean drastic changes to your Will, and in some circumstances they could even lead to your Will being invalidated, if it hasn’t been kept current and up to date. If you want to make sure that your plans for the future are as concrete as possible, it does mean taking the time to recognise that your Will is a living document that reflects where you’re at with life and with your affairs.

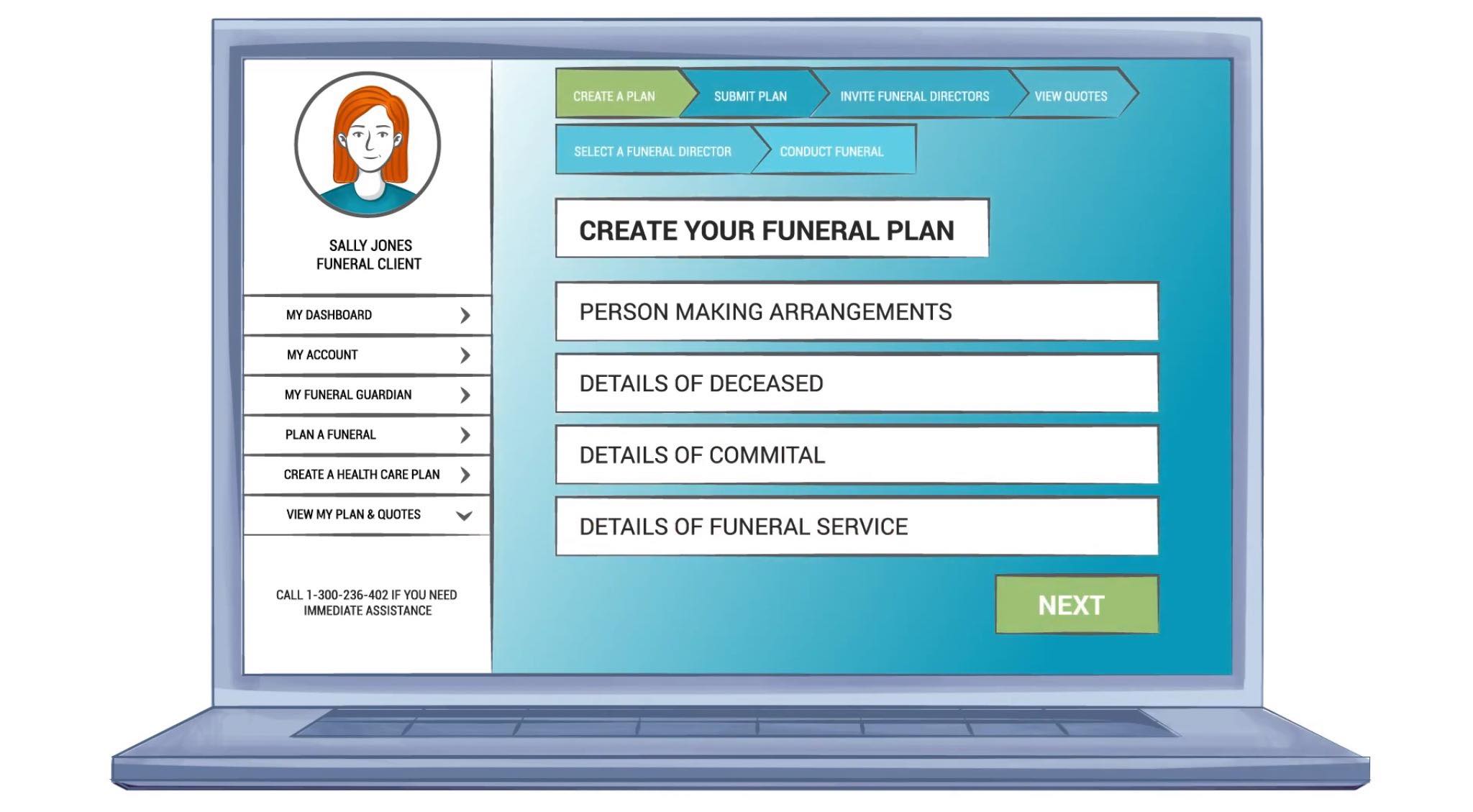

The good news is that getting your Will sorted can be a quick and simple process, with only 20 minutes needed from start to finish!

About eziFunerals

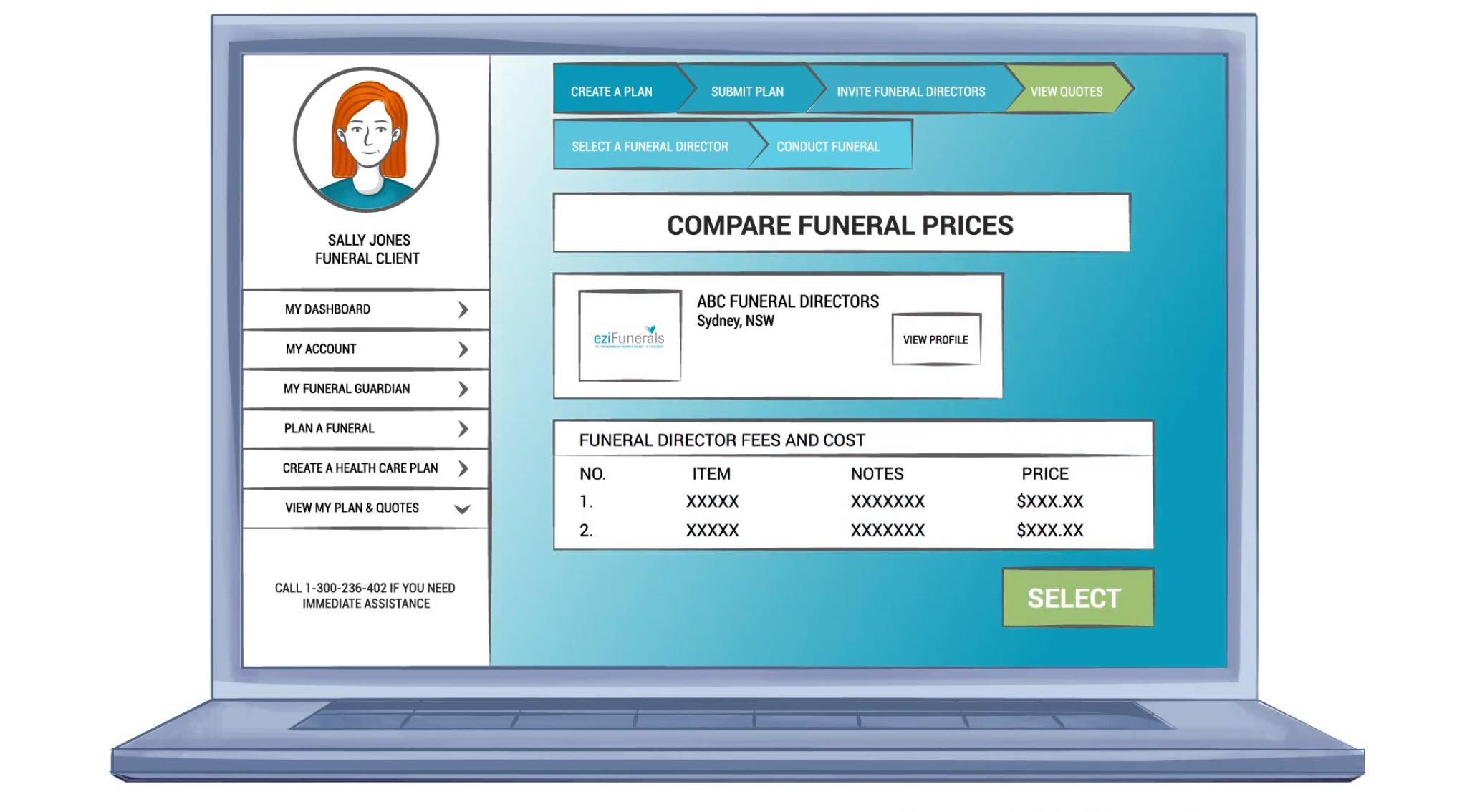

eziFunerals supports individuals and families coping with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company. We are not part of any other funeral company.

Our member Funeral Directors operate in Sydney, Melbourne, Brisbane, Perth, Adelaide and Australia wide. They are chosen for their knowledge, quality, service, personalisation and experience. They go above and beyond, and will take the time to support the family.

For more information or to make contact with a trusted Independent funeral director, call eziFunerals on 1300 236 402 or visit www.ezifunerals.com.au.