What is a Funeral Bond?

A funeral bond is an investment with the purpose of meeting the costs of future funeral expenses. A Funeral Bond can be an effective solution for those wishing to ensure the expense of their funeral is covered and their loved ones are not burdened with these costs.

A funeral bond can be either assigned (assigned to a nominated funeral director) or unassigned (a funeral director is not nominated).

Upon death, the capital and bonuses are paid to either a pre-designated funeral director or to the Estate. The capital is guaranteed, and that capital earns bonuses which accumulate within the fund. The investment, including bonuses, cannot be withdrawn prior to death. Funds can be invested as a lump sum, or as an instalment plan, but the amount invested should not exceed the expected funeral costs.

A Funeral Bond can be advantageous from a tax and social security perspective.

How do Centrelink/DVA Assess Funeral Bonds?

Centrelink/DVA apply a Funeral Bond Allowable Limit. The Funeral Bond Allowable Limit as at 1 July 2020 is $13,500 and is indexed in line with CPI pension increases each year on 1st July. An exempt Funeral Bond must meet the following criteria;

- The interest must be added to the capital i.e. it cannot be withdrawn.

- The funds cannot be accessed prior to death.

- The investment cannot exceed the exempt funeral investment threshold.

Exempt Funeral Bonds that meet the criteria are not assessed by Centrelink/DVA (the investment is exempt from both the assets and income test).

How are Funeral Bonds Taxed?

A Funeral Bond is a tax-paid investment. What that means is; the investment earnings are not taxed in the hands of the Funeral Bond holder and do not need to be included in the investor’s annual tax return.

At time of claim – Assigned

If the funeral bond is assigned to a funeral director as part of a pre-paid funeral contract then the entire amount is paid out to the funeral director and this total amount becomes assessable income in the hands of the funeral director. The member’s Estate does not have to include any of these earnings in their taxable income.

At time of claim -Unassigned

If the funeral bond is not assigned to a funeral director then the entire investment income component of the funeral bond will need to be included in the assessable income of the member’s Estate. In these circumstances, Foresters will issue a statement advising the member’s Estate of the amount of income to be included in the tax return.

Example – Unassigned

Let’s assume that a funeral bond was taken out with an initial capital investment of $10,000. Over time with the addition of annual bonus entitlements the funeral bond had grown to $13,700, representing an increase of $3,700.

If the bond is not assigned, then after paying out the claim a statement will be issued to the member’s Estate to advise that they need to also include $3,700 in their final tax return as this amount represents the entire income component of the member’s funeral bond investment.

How do Funeral Bonds Differ from Pre-paid Funerals?

A prepaid funeral plan is where a person makes an advance payment for funeral services for themselves or their partner. With a prepaid funeral plan, all of the funeral arrangements are made with a funeral director in advance at ‘today’s prices’ and:

- there is a contract specifying the pre-arranged funeral services which will be provided

- nothing further needs to be done for the funeral services to be provided in accordance with the contract

- the prepayment cannot be refunded, unless the person moves outside the designated funeral service area.

Prepaid funeral contracts are regulated by state legislation. Most states have legislation that regulates the requirements for prepaid funeral consumer contracts. Each Act requires that money paid to the funeral provider in respect of a prepaid funeral contract is to be held in an account with a friendly society or other registered organisation.

A prepaid funeral plan may involve you assigning a funeral bond to the funeral director as payment. This assignment transfers the ownership of the funeral bond to the funeral director and you are the owner of the prepaid funeral plan, not the assigned funeral bond.

How are prepaid funeral plans assessed under the income and assets tests?

A prepaid funeral plan is not counted under the income and assets tests, regardless of the prepaid amount. Unlike a funeral bond, the current threshold limit does not apply to prepaid funeral plans.

If you have a prepaid funeral plan and have a funeral bond as well, the funeral bond will be counted as an asset and assessed under the deemed income rules.

*Note: – If you buy a cemetery plot for yourself without prepaying your funeral services, the value of the cemetery plot, regardless of its value, is not counted under the income and assets tests.

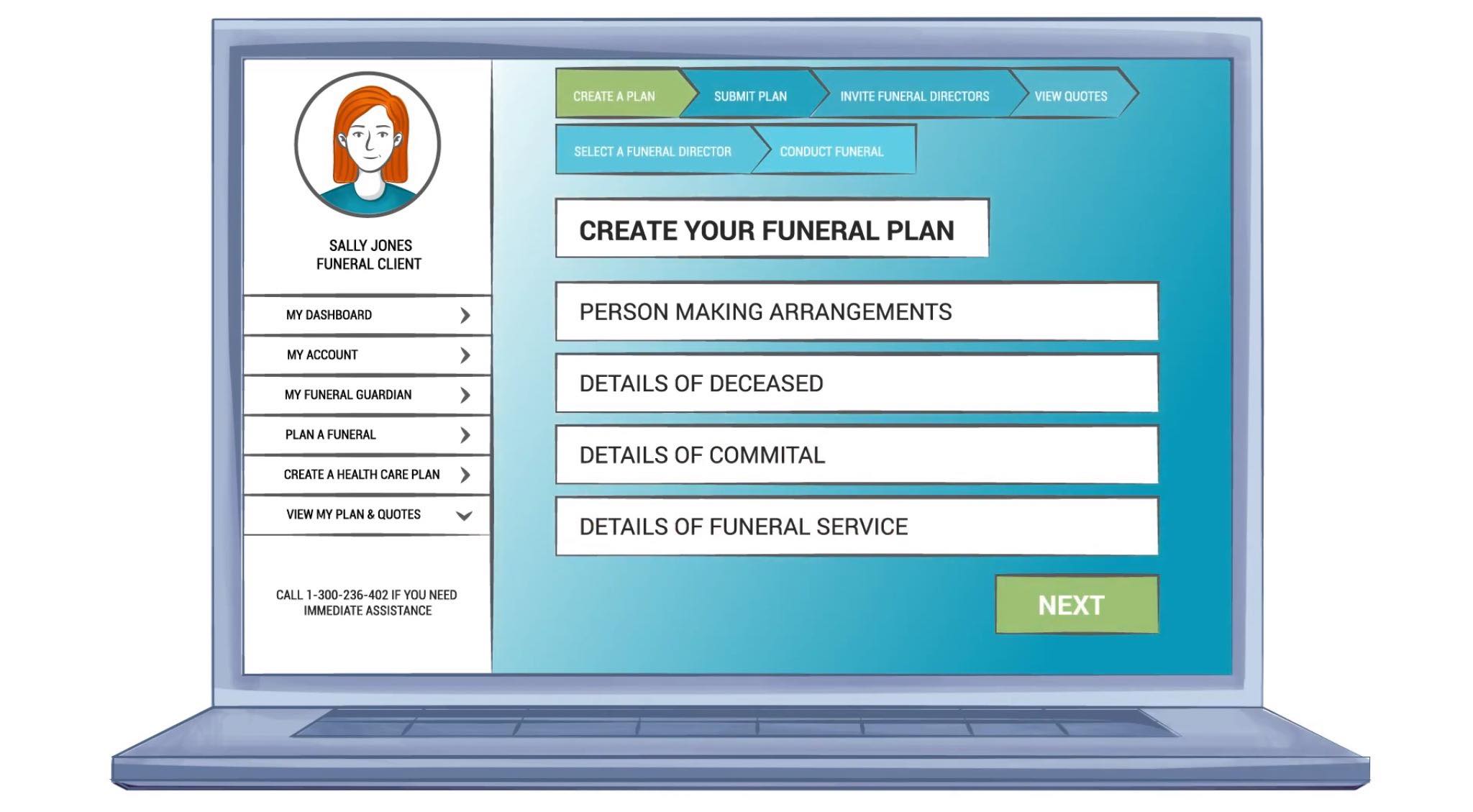

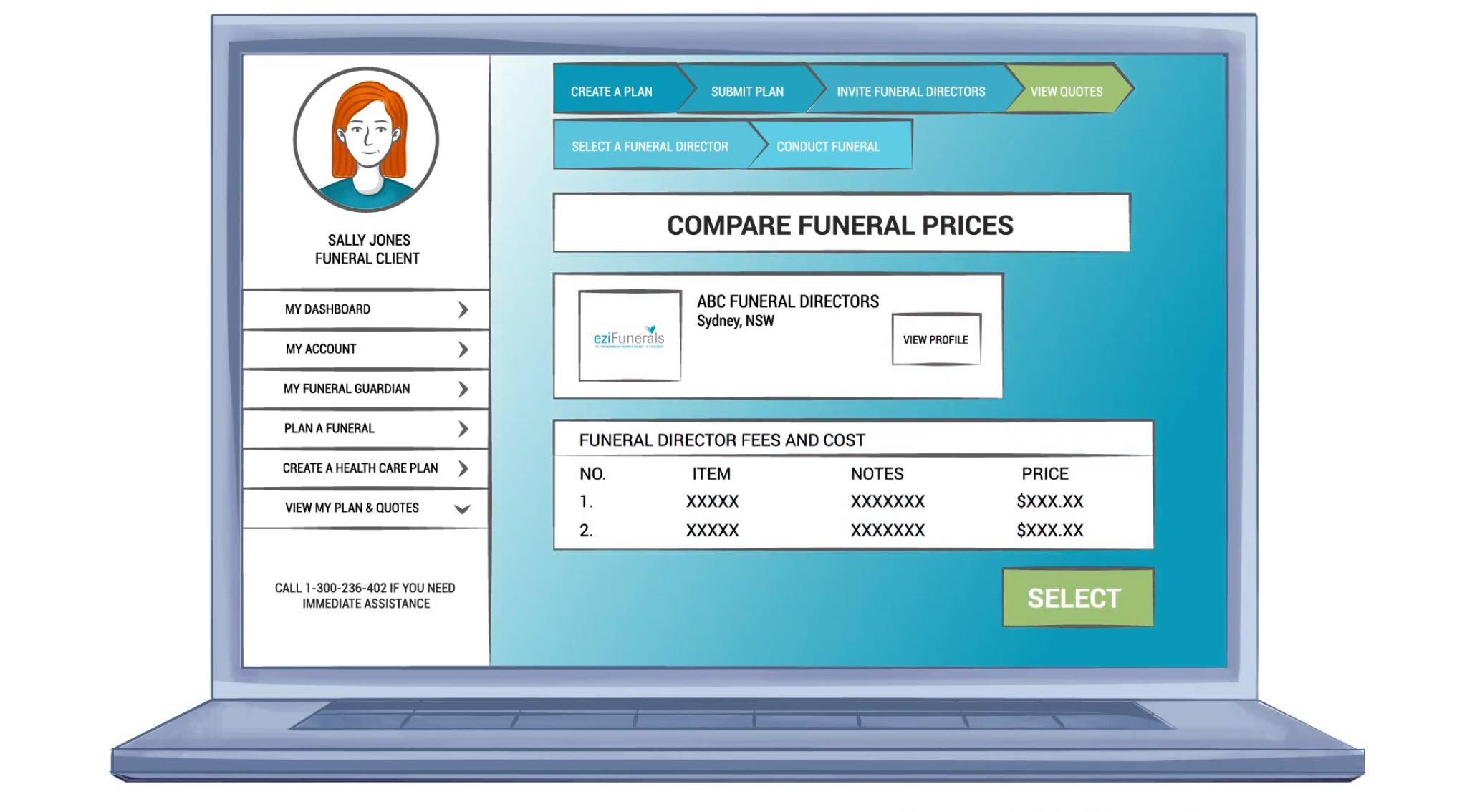

About eziFunerals

eziFunerals supports individuals and families coping with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company. We are not part of any other funeral company.

Our member Funeral Directors operate in Sydney, Melbourne, Brisbane, Perth, Adelaide and Australia wide. They are chosen for their knowledge, quality, service, personalisation and experience. They go above and beyond, and will take the time to support the family.

For more information or to make contact with a trusted Independent funeral director, call eziFunerals on 1300 236 402 or visit www.ezifunerals.com.au.